First built by an English chemist working at Stanford University in the USA in 1970, it took close to 40 years for Lithium-ion (LiCoO2) batteries to get from the lab to widescale adoption in the marketplace. There were a few technical improvements required, developed by academics in the US and Japan, mostly, with commercial support coming from Exxon and BASF, among others. The final formulation ultimately using cobalt as a key material.

Given the unprecedented demand for long-lasting and highly stable batteries due to the upsurge in electric vehicle usage, we can expect the reformulated Lithium Iron (LiFePO4) batteries to get to market much, much more quickly.

All commercially applicable technology has to serve a real market need and sometimes that means the most impressive technology, viewed in its own terms, loses out to other less compelling but more immediately applicable technology. Sometimes this is a matter of cost (why have something twice the price that is only 10% better?), sometimes the way it the tech combines with other tech (there is no point having a world’s best digital tuner, if the speakers are not able to reproduce the sound), sometimes it is the state of the infrastructure within which the technology will need to operate (a world-beating hydrogen engine is not good to a consumer who cannot easily buy the gas for her car).

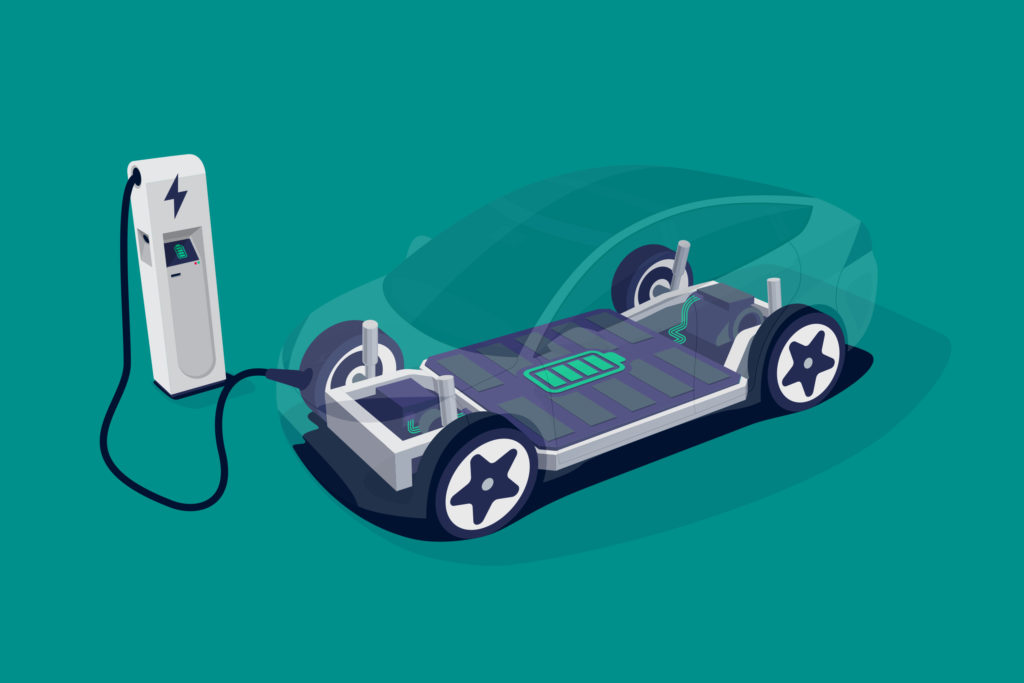

In the case of lithium-iron batteries, all these advantageous scenarios are true. Lacking the high-cost cobalt element, they are cheaper than their predecessors. In the case of power units for cars, the much longer life of the iron batteries represents less hassle and in the long run, even less cost for the driver. The infrastructure is (mostly) in place for charging batteries of either type but the greater range of cars using li-iron batteries means that the infrastructure can serve more vehicles more easily as they will need to be charged less often.

Ironically, the widespread adoption of lithium-ion batteries has accidentally caused its own downfall as the preferred rechargeable power source, as its key supplemental metal, cobalt, is not found in sufficient quantities for these batteries to be produced at a sensible price, given the high present and likely future demand (cobalt costs upwards of $50,000 a ton). By contrast, the Lithium Iron alternative is cheaper and, in the specific setting of vehicle applications, can be more effective than its higher charge bearer rival, as it is stabler and much longer lasting.

It was probably to be expected then, that in 2020 Elon Musk announced that his company, Tesla, will be producing their own version of a Lithium Iron battery (and it has now opened a factory in China to manufacture the new batteries there). At the time of writing (2021) the market is really hotting up, with battery prices (measured $ per kWh) at, or already below, internal combustion engine (ICE) parity (that is to say, in theory, a car maker can now make an electric car at the same price as an ICE car). Batteries in this class, manufactured at volume, now come from Panasonic, LG Chem NCM, CATL LFP, and BYD Blade. Also Bill Gates’ start-up, QuantumScape, formed a joint venture with VW last year and expect to be challenging within 4 years.

With the market for Lithium Iron batteries becoming so much more competitive, the future for consumers of the technology looks good. Widespread adoption of the improved Li-Iron batteries will significantly support the growth of electric vehicles worldwide.

With prices falling, along with the other highly valued aspects of electric engines, the next generations of EVs will see the beginning of the end for ICE. The roar of a Ferrari will, in time, seem as strange as the hiss and crackle spoiling the music on a long-wave radio.

Given the excitement surrounding the technology, it is no surprise to find that our database lists well over 3,000 related technologies from more than 400 universities and research institutions. In such a situation, picking ‘top institutions’ is very tricky. We could work off technology offers (research that is being promoted to industry, rather than patents) as this narrows the field considerably. The justification for ignoring patents would be that some institutions churn out patents, encouraged by government research grants linked to patent numbers, whereas an offer is usually made only when the institution believes somebody will be likely to want to commercialise its technology. However, this approach produces a top 4 list that is entirely US-based, whereas including recent patents produces a top 4 that is entirely Chinese, so one has to be very wary before ignoring patent activity.

Our own view is that given the broader interest in this area of energy technology (China is still in the process of getting some of its regions fully electrified), it is the Chinese institutions that will come to dominate this area, but others, especially in the US and Europe, will continue to make powerful contributions to global research.